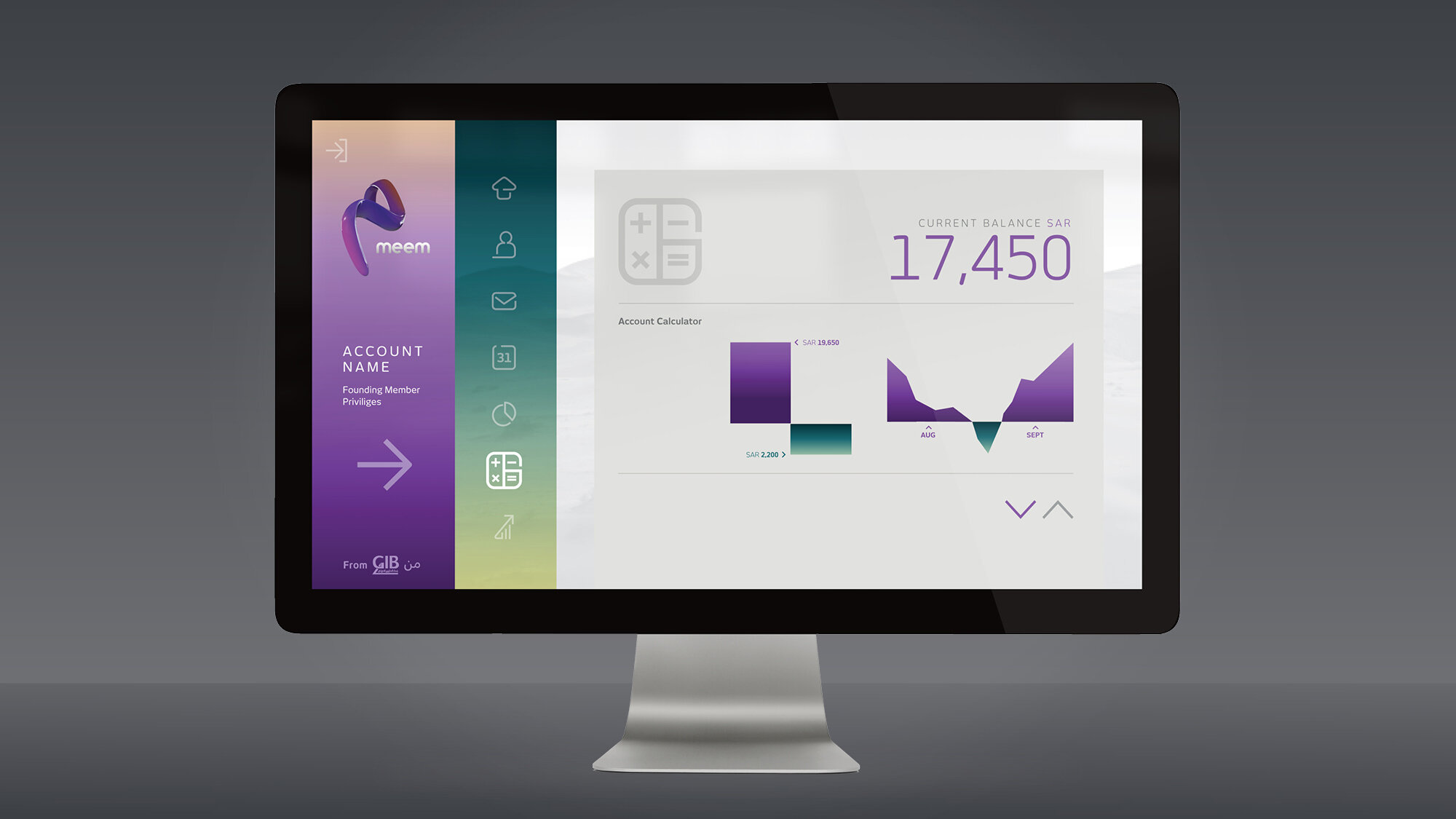

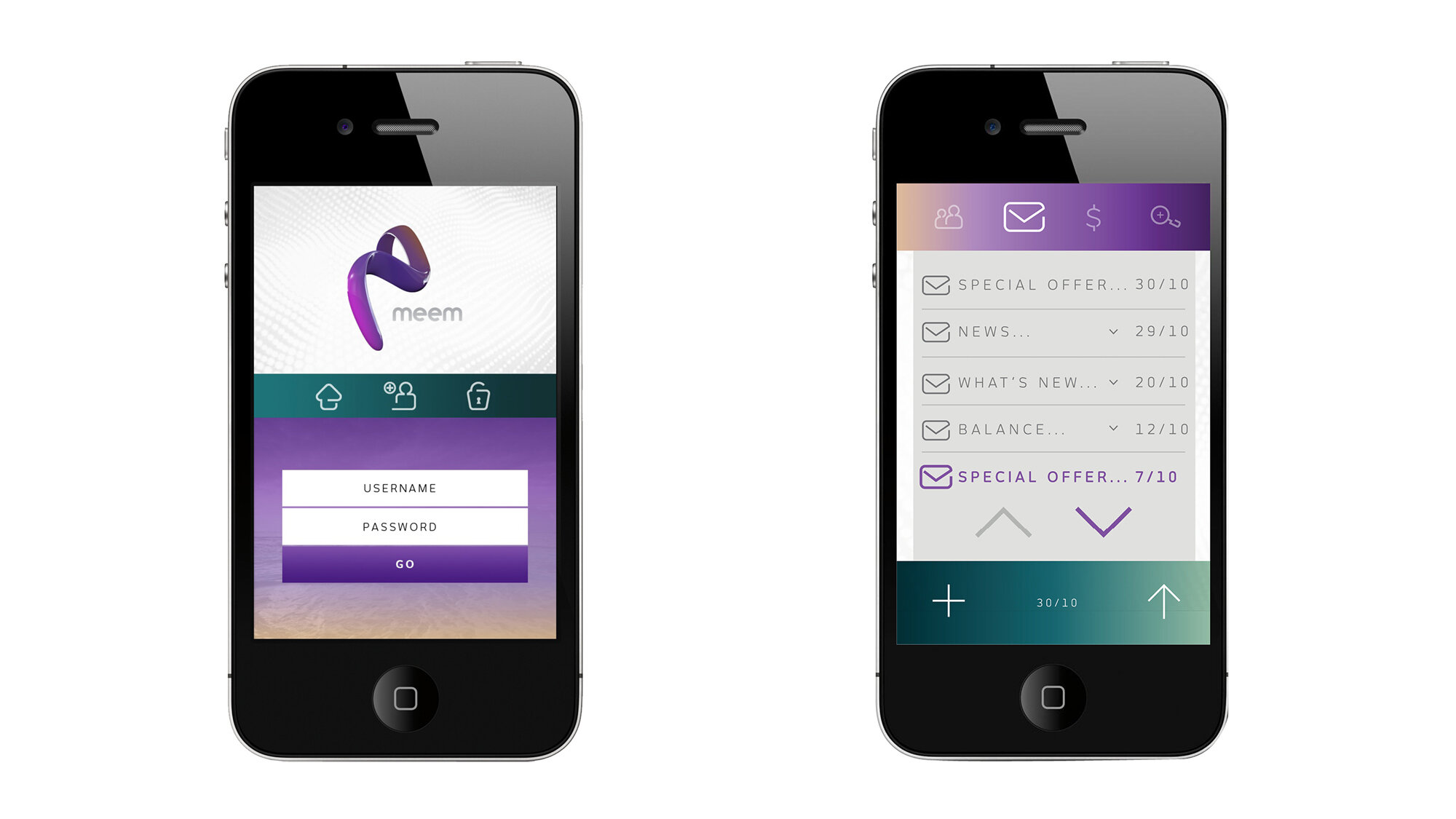

Co-creating the Middle East’s first digital bank

Meem by GIB, Bahrain & KSA

From co-creation, brand strategy, positioning, naming, and architecture to sensory identity, brand voice, messaging, and multichannel activation

A new way of banking

Established in 1975, Gulf International Bank is headquartered in Bahrain. The bank caters to corporations and institutions by offering merchant banking, asset management and treasury products. As part of its corporate transformation programme, GIB created a new retail bank. It fundamentally adjusted its strategy and business model from a wholesale business into a well-diversified yet customer-segmented targeted universal commercial bank with a pan-GCC presence. Seeking to establish a new concept in retail banking, GIB determined the retail bank should mainly cater to and appeal to a growing tech-savvy audience demographic and intended first to launch the concept in the Kingdom of Saudi Arabia.

Harnessing the crowd

Given GIB’s low retail banking association and awareness, a multi-brand strategy was required. With a primary focus towards developing an e-channel-led proposition, seeking to build credibility in retail banking, we set out to validate conceptual ideas by engaging with those who mattered most in achieving the bank’s ambition, the end-user. We set up and engaged in dialogue with informed consumers to capture the most relevant insights. Our approach to engagement and co-creation helped teams from across the business better understand needs, motivations, spending behaviours, social habits and preferences. Utilising a purpose-built, online co-creation platform, we created an online community of profile-matching consumers and facilitated dialogue and discussion. Defining, validating, and fine-tuning a compelling Brand Value Proposition and Brand Service Philosophy for a new digital bank.

Measurable results

Meem launched in Saudi Arabia, then in Bahrain. Combining digital and traditional banking ( through physical locations), customers can open an account and on-board through multi-optional online channels — catering to the region's increasingly sophisticated retail banking segment — offering customers convenience, freedom of choice and exceptional value for money. As the first Shariah-compliant digital bank, Meem’s smart onboarding application process provides a seamless account opening experience, supported by round-the-clock customer service, by a host of accessible on and off-line community channels. In 2017, GIB reported strong financial performance, attributing prompt realisation and return on investment in the new digital retail banking proposition.

“We are pleased to see Meem begin its operations. The launch underlines the Central Bank of Bahrain’s ongoing commitment and success in attracting FinTech specialists to the kingdom and strengthening the country’s FinTech ecosystem.”

Rasheed Al Maraj, Governor of the Central Bank of Bahrain

CREDITS

Principal Consultant: Dan Dimmock, FutureBrand

Brand Strategy, Architecture and Identity: FutureBrand